Hi Readers

M1 (B2F.SI) is on my watchlist for awhile partly because of its regular dividend payments. Furthermore, I have 4 mobile plans under M1 and it will be nice if M1 give me a cut of their profit =). With the sales launch of Iphone 6 & 6 plus on 15 Sept, M1, together with other telco companies, has raised the monthly subscription rates their mobile price plans. The raise of the prices will not stop Apple fanatics from getting their hands on the new Iphones, trust me. This will definitely bring about more profits for the Telcos in the long run as they have very good pricing powers. Furthermore, I will pretty much like to have a defensive utility stock that pay good dividends like M1 in my portfolio.

Ok, enough said about things we already know about M1. Based on its closing price on 15 Sept below is the chart that tells us about M1's price movement:

I used the following indicators for the above chart:

1) Boilinger Bands (20MA +/- 2 Standard Deviations) = the Purple twin-line band

2) 21 Day Moving Average to give me the mid-line of the Boilinger Band = Red line

3) 60 Day Moving Average = Green line

4) MACD at default settings

5) RSI at default settings to tell me when the shares are overbought & oversold.

If you looked carefully at the 21MA & 60MA (red & green lines), they are beginning to converge and this shows that the price is going to be bearish in the near future. Usually, if you were to wait for the 21MA to cross under 60MA, the price would have dropped too much. However, having said that, there may be a possibility that both MA line may diverge and it will become a bullish trend.

Next, the MACD is telling us that the price is currently bearish (blue line riding above red line).

If we observe the price line upon the Boilinger Band, the candlesticks are riding very closely to the bottom band with some candlesticks crossing below the bottom band. By looking at how the Boilinger Bands diverging away from each other on a down trend, this can be seen as a strong bearish trend and that the price can be expected to fall further.

RSI, however, indicates that the shares are currently oversold and we may see that investors may be starting to buy M1 shares again.

The above technical analysis is largely based on what I have observed so far. I have yet to attend the Chartnexus course as I'm still saving up for the course fees. LOL.

To summarise, below are the signs that tells me that M1 price is gonna drop further:

1) Candlesticks riding below 21MA.

2) Candlesticks riding near lower Boilinger Band with some dropping below the bottom band.

3) 21MA and 60MA lines are coverging, which we can predict that they may cross over soon.

4) MACD indicate that it's a bearish trend and both red & blue lines are diverging away from each other.

5) Boilinger Bands are widening in both directions on a down trend which indicate a strong bearish mode.

The only sign that does not agree to the above is the RSI which indicate an oversold status.

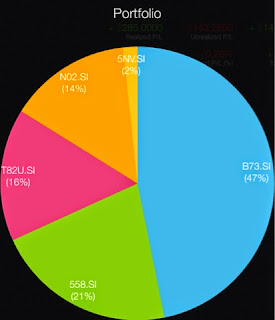

I will be watching this very closely and based on its 2013 dividends of 21 cents, it will have a dividend yield of 5% if I enter at a price of $3.50. Hopefully, that will happen based on what I observed so far and it will be great to have M1 as part of my portfolio. =)

Happy Investing!

Rat Racer